Sales use tax software is revolutionizing how businesses manage their tax obligations. It automates complex calculations, ensuring accuracy and compliance with ever-changing regulations. This sophisticated technology offers a streamlined approach to handling sales tax, freeing up valuable time and resources for core business functions.

By leveraging intuitive interfaces and robust reporting tools, businesses can gain real-time insights into their tax liabilities. This data-driven approach empowers informed decision-making and helps prevent costly errors. Moreover, the best software options often integrate with existing accounting systems for seamless data flow.

Sales use tax software is crucial for businesses operating in jurisdictions with sales and use tax requirements. This software streamlines the complex process of calculating, collecting, and remitting taxes, ensuring compliance and reducing the risk of penalties. This guide delves into the features, benefits, and considerations for choosing the right sales use tax software for your business.

Understanding Sales and Use Tax

Sales tax is levied on the sale of goods and services, while use tax is levied on the use, storage, or consumption of tangible personal property. Understanding the nuances of both is essential for accurate tax calculation and reporting. Different jurisdictions have varying rates and regulations, making accurate tax calculations crucial. This necessitates the use of reliable sales use tax software.

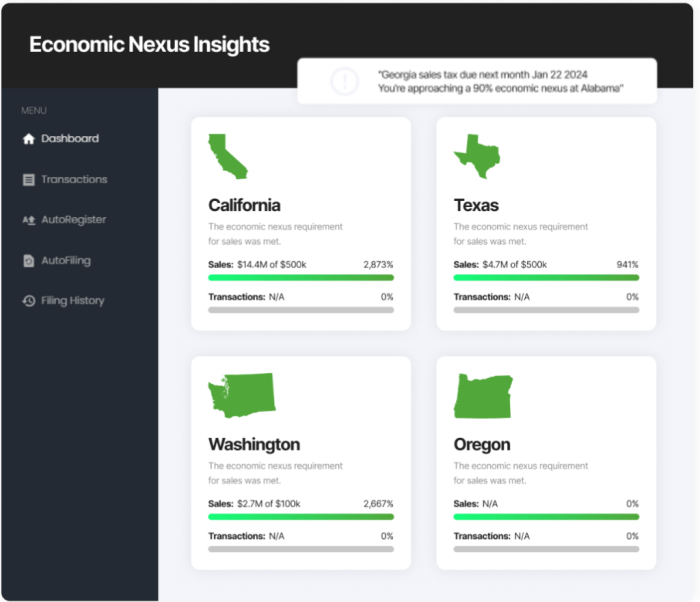

Source: wolterskluwer.com

Key Components of Sales Use Tax Software

- Tax Rate Management: The software should allow for easy input and updates of tax rates specific to each jurisdiction.

- Sales Data Integration: Seamless integration with existing point-of-sale (POS) systems is vital for accurate tax calculation based on real-time sales data.

- Tax Calculation Engine: The software must accurately calculate the appropriate sales and use tax amounts based on the transaction details and applicable rates.

- Reporting and Compliance: Comprehensive reporting features are necessary for generating tax reports, preparing for tax audits, and ensuring compliance with regulatory requirements. This includes the generation of reports for sales tax nexus, for example.

- Remittance Management: The software should facilitate the timely and accurate remittance of sales tax payments to the appropriate tax authorities. This should include tracking of payments made.

Benefits of Using Sales Use Tax Software

Implementing sales use tax software offers a multitude of benefits for businesses, including:

- Accuracy and Efficiency: Automated tax calculations minimize errors and save time compared to manual calculations.

- Compliance Assurance: The software helps businesses stay compliant with ever-changing tax regulations, reducing the risk of penalties and legal issues.

- Reduced Administrative Burden: Automation streamlines tax processes, freeing up staff to focus on core business activities.

- Improved Financial Management: Accurate tax reporting allows for better financial planning and forecasting.

- Data Analysis Capabilities: Advanced sales use tax software can provide insights into sales trends and tax liabilities, helping businesses make informed decisions.

Choosing the Right Sales Use Tax Software

Several factors should be considered when selecting sales use tax software:

- Scalability: The software should adapt to the evolving needs of your business.

- Integration Capabilities: Consider compatibility with existing systems like accounting software or POS systems.

- User-Friendliness: A user-friendly interface is crucial for easy adoption and efficient use by staff.

- Customer Support: Reliable customer support is essential for addressing technical issues and providing guidance.

- Pricing and Features: Compare different software packages based on your specific needs and budget. Look for value-for-money solutions.

Frequently Asked Questions (FAQ)

Here are some common questions about sales use tax software:

- Q: How much does sales use tax software cost?

A: Pricing varies significantly depending on features, functionalities, and support packages. Contact vendors for specific quotes. - Q: Can I integrate my existing POS system with the software?

A: Many sales use tax software solutions offer POS integration, allowing for seamless data flow and automated tax calculations. - Q: How do I stay updated on changes in sales tax laws?

A: The software should provide regular updates on changes in tax regulations and ensure compliance with the latest rules. - Q: What are the different types of sales use tax software available?

A: Software can range from cloud-based solutions to on-premise options. Some offer specific industry solutions, tailored for e-commerce, for instance.

Conclusion

Sales use tax software is an essential tool for businesses navigating the complexities of sales and use tax compliance. By carefully evaluating your needs and choosing the right software, you can streamline your tax processes, ensure accuracy, and reduce the risk of penalties. Choosing the right software is a critical business decision.

Call to Action

Ready to streamline your sales tax processes? Contact us today for a free consultation and discover how our sales use tax software can help your business thrive.

Resources:

Source: sovos.com

- [Insert Link to a reputable tax authority website]

- [Insert Link to a credible sales tax software provider]

In conclusion, sales use tax software offers a powerful solution for businesses of all sizes seeking to navigate the complexities of sales tax. From automated calculations to detailed reporting, these tools empower businesses to maintain accurate records, comply with regulations, and optimize their financial operations. Ultimately, embracing this technology can significantly reduce administrative burdens and improve overall efficiency.

Source: atomictax.com

FAQ Corner: Sales Use Tax Software

How can I choose the right sales tax software for my business?

Consider your business size, industry, and specific sales tax requirements. Research different software options, read reviews, and evaluate their features and pricing. Trial periods often allow you to test compatibility with your existing systems.

What if I make a mistake in my sales tax filings?

Consult with a tax professional immediately. They can help you understand the implications of the error and guide you through the necessary corrective actions to minimize penalties.

Does the software integrate with my existing accounting software?

Many sales tax software solutions offer integrations with popular accounting platforms. Check the software’s compatibility list to ensure seamless data transfer and avoid manual entry errors.

What are the common sales tax compliance requirements?

Specific regulations vary by state and locality. Consult with a tax professional or relevant state authorities to ensure you’re meeting all applicable requirements for your jurisdiction.