Sage fixed assets software provides a comprehensive solution for managing your company’s fixed assets, from initial acquisition to eventual disposal. This software streamlines the entire process, ensuring accurate record-keeping and efficient reporting. It offers powerful tools for tracking depreciation, maintenance schedules, and asset valuations, ultimately improving financial accuracy and decision-making.

The software’s intuitive interface simplifies data entry and reporting, allowing users to easily access and analyze critical information. Furthermore, its robust features ensure compliance with accounting standards and regulations, safeguarding your company’s financial integrity.

Sage Fixed Assets software is a powerful tool designed to manage and track fixed assets within a business. This detailed guide explores its features, benefits, and how it can improve your asset management processes. We’ll cover everything from initial setup to ongoing maintenance, and provide insights into optimizing your fixed asset accounting.

Understanding Fixed Assets and Their Importance

Fixed assets are tangible, long-term assets used in the operation of a business, such as machinery, equipment, vehicles, and buildings. Proper management of these assets is crucial for accurate financial reporting, tax compliance, and overall business efficiency. Efficient fixed asset tracking allows businesses to understand their asset value, depreciation, and maintenance costs, ultimately impacting profitability and decision-making.

Key Benefits of Using Sage Fixed Assets Software

- Accurate Depreciation Calculation: Sage automates the calculation of depreciation, ensuring compliance with accounting standards and tax regulations.

- Improved Asset Tracking: Detailed records of assets, their acquisition costs, and maintenance history are readily available.

- Enhanced Reporting Capabilities: Customizable reports provide insights into asset values, depreciation schedules, and maintenance costs.

- Streamlined Maintenance Management: Schedule and track maintenance activities for optimal asset lifespan and reduced downtime.

- Simplified Compliance: Sage ensures adherence to tax regulations and accounting standards related to fixed assets.

Features of Sage Fixed Assets Software

Sage Fixed Assets software typically includes a suite of features designed for efficient asset management. Key features often include:

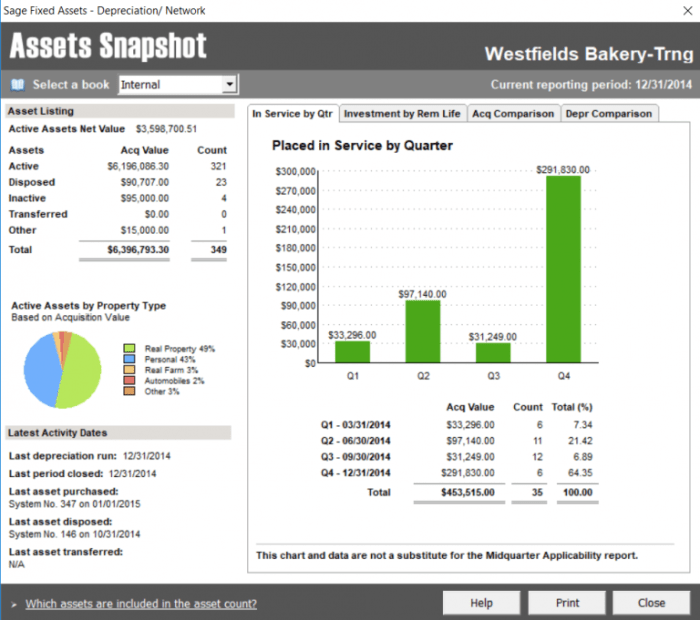

Source: acutedata.com

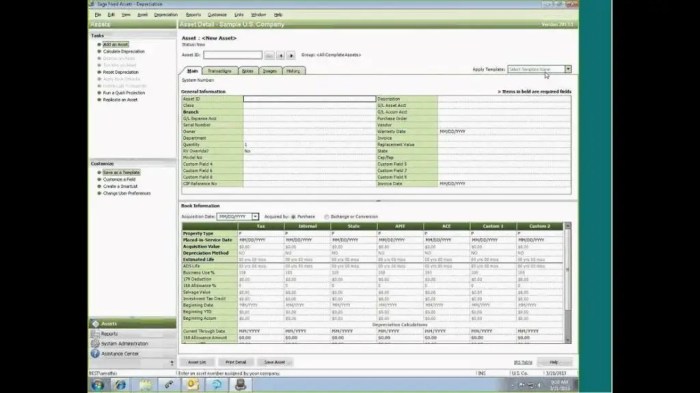

Asset Acquisition and Disposal

The software facilitates the recording of asset acquisition details, including date, cost, description, and other relevant information. It also streamlines the process for asset disposal, including calculating gains or losses.

Depreciation Management, Sage fixed assets software

Accurate depreciation calculations are automated, using various methods such as straight-line, declining balance, or sum-of-the-years’ digits. This ensures compliance with accounting standards and tax laws. Choosing the right depreciation method is a crucial element.

Maintenance Tracking

Users can schedule, track, and record maintenance activities for each asset. This allows for proactive maintenance, reducing unexpected downtime and extending the lifespan of equipment. Detailed maintenance records are crucial for future planning.

Reporting and Analytics

Comprehensive reports provide valuable insights into asset values, depreciation schedules, and maintenance costs. These reports can be customized to meet specific business needs, allowing for data-driven decision-making.

Implementation and Integration

Implementing Sage Fixed Assets software often involves data migration from existing systems, configuration of the software to match specific business needs, and user training. The software can often integrate with other Sage business management applications, streamlining data flow and reducing manual data entry.

Choosing the Right Sage Fixed Assets Solution

Selecting the appropriate Sage Fixed Assets solution depends on various factors, including business size, industry, and specific needs. Consider factors like the number of assets, the complexity of depreciation calculations, and the level of reporting requirements. It’s advisable to compare different software solutions to find the best fit.

Frequently Asked Questions (FAQ)

- Q: How much does Sage Fixed Assets software cost?

A: Pricing varies based on the specific Sage Fixed Assets solution, the number of users, and the chosen subscription model. Contact Sage directly for detailed pricing information.

- Q: Is Sage Fixed Assets software compatible with other accounting software?

A: Yes, Sage Fixed Assets often integrates seamlessly with other Sage business management applications. However, compatibility with other third-party software may vary.

- Q: What are the key differences between different Sage Fixed Assets software packages?

A: The differences often lie in the level of features, user interface, reporting capabilities, and support offered. Consider your specific needs and budget when choosing the right package.

Conclusion

Sage Fixed Assets software offers a comprehensive solution for managing fixed assets, from initial acquisition to disposal. Its automation of tasks like depreciation calculation, maintenance tracking, and reporting significantly enhances efficiency and reduces administrative burden. Careful consideration of your business needs and a thorough evaluation of various software solutions will lead to a successful implementation and maximize the benefits of using Sage Fixed Assets software.

Call to Action

Ready to streamline your fixed asset management? Contact a Sage representative today for a personalized consultation and learn how Sage Fixed Assets can improve your business efficiency and profitability. Visit the Sage website for more information and to explore the different fixed asset management software packages.

Note: This article is for informational purposes only and should not be considered financial or professional advice.

References:

In conclusion, Sage fixed assets software empowers businesses to effectively manage their fixed assets, optimizing financial performance and minimizing administrative burdens. By automating crucial tasks and providing insightful reports, this software equips organizations with the tools necessary to maintain accurate records, comply with regulations, and ultimately, achieve their financial goals. It’s a valuable investment for companies seeking to streamline their fixed asset management.

FAQ Corner: Sage Fixed Assets Software

How does Sage fixed assets software handle different asset types?

The software categorizes and tracks various asset types, enabling tailored depreciation calculations and maintenance schedules based on specific characteristics. This ensures accurate accounting for all your assets.

What kind of reporting features are available?

Sage fixed assets software provides a wide range of customizable reports, including depreciation schedules, asset valuations, and maintenance history. These reports help track performance, identify trends, and make data-driven decisions.

Is integration with other Sage software possible?

Yes, Sage fixed assets software often integrates seamlessly with other Sage products, allowing for a unified and comprehensive view of your business’s financial data.

Source: techyv.com

What are the typical security measures implemented?

Robust security measures are in place to protect sensitive financial data, ensuring compliance with industry standards and safeguarding your company’s information.